Our legacy

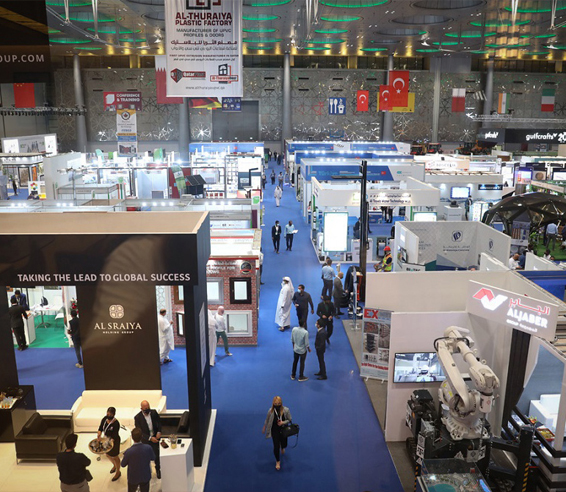

Al Sraiya Holding Group is a family-owned conglomerate based in Qatar, deeply rooted in the nation's enduring development journey. Since its founding in 1975, the Group has grown into a diversified powerhouse with investments across four key sectors—Construction, Industrial, Hospitality, and Trading and Services—serving as organizational pillars for specialized businesses. Guided by the values of its founding family, Al Sraiya remains committed to quality and excellence—having established a legacy that continues to support Qatar’s progress and leaves a lasting impact beyond its borders.

3

continents

Al Sraiya Group boasts a strong global presence with investments and strategic partnerships spanning the globe.

25 k

Workforce

With over five decades of legacy, we continue to build on a foundation of trust, expertise, and national service.

48 +

companies

Al Sraiya Group boasts a dynamic portfolio spanning diverse industries in Qatar and beyond.

Sustainability

With over 50 years of heritage, we are committed to responsible growth that prioritizes long-term positive impact. By integrating sustainable practices across all sectors of our business, we aim to foster a more resilient future for the generations to come, ensuring our legacy benefits both people and the planet.

Our goal

Our history

“By embracing sustainability we help position Qatar as a global leader in responsible tourism, aligning with the nation’s vision to create a diversified and resilient economy for generations to come..”

Al Sraiya Group

Careers

We are committed to fostering a dynamic work environment that values integrity, and growth. As we continue to expand across diverse sectors, we are always on the lookout for talented, passionate individuals to join our team. Whether you are looking to make an impact, collaborate with brilliant minds, or grow in your career, Al Sraiya Holding Group is the place for you. Ready to take the next step?

News & Insights

View all stories

The Westin Warsaw Earns Marriott’s TakeCare Certification

Doha, Qatar – May 2025 — The Westin Warsaw, a flagship European property of Al Sraiya Hotels &…

Read More

Munich Marriott Hotel Achieves Green Key Certification, Reinforcing Al Sraiya Hotels & Hospitality Group’s Global Sustainability Commitments

Doha, Qatar – April 2025 — Al Sraiya Holding Group proudly commends the Munich Marriott Hotel on…

Read More